2016 Top Management Challenges

for State & Local Government

An annual study of public sector employees, conducted by Route Fifty and Government Business Council

2016 Top Management Challenges

for State & Local Government

An annual study of public sector employees, conducted by Route Fifty and Government Business Council

Among the six major issues studied, state and local employees are most concerned about the government workforce. About half of agency executives, and even more lower level employees, worry about the ability to recruit and hire talent for public service. This area is of of particular concern as organizations look to fill the long-held positions of retiring baby boomers.

These human capital concerns carry through in agency IT management, where less than half of respondents believe their organizations have the ability to recruit for skilled IT expertise. Even fewer employees feel that their agencies have adequate funding for IT modernization efforts, while others point to hurdles in the acquisition process that make it difficult to maintain up-to-date technology.

Respondents also report significant concerns regarding both budget planning and data-based decision making. Those serving in Executive Office oversight organizations (i.e., headquarters offices) are particularly concerned about the accuracy of the data, while surveytakers at large acknowledge that even with the data available, few employees are equipped with the training and skills needed to make use of it.

When asked to rank organizational challenges, state and local government employees place the six management areas in the following order, from most challenging to least:

#1 Human Capital and Workforce Issues

#2 Budget Planning Process

#3 IT / Technology Management

#4 Collaboration

#5 Data-driven Decision Making

#6 Acquisition and Procurement

State and local employees overwhelmingly identify human capital and workforce issues as the top management challenge for their organizations. A full 90% of respondents indicate this area to be challenging, with a 37% plurality ranking it as the number one challenge they face.

Within this issue area, the anticipated departure of experienced employees is of particular concern for many state and local employees. Only 41% of respondents believe that their organization is prepared for the coming retirement wave of baby boomers. As one respondent put it, “Workforce aging and retirements across the board in key management positions [are] leaving a void in institutional knowledge.” Another respondent noted that the large number of retirees “are not being replaced [and] the brain drain and loss of institutional memory is critical.”

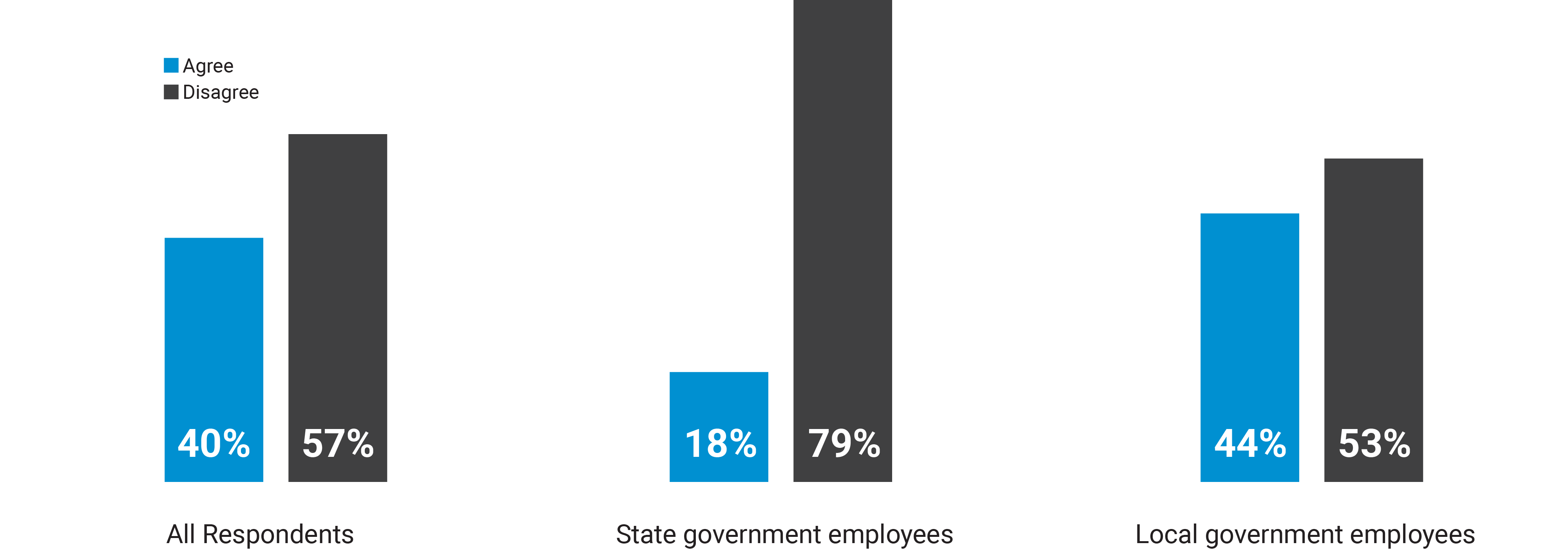

Human capital losses appear to be further exacerbated by a lack of confidence in the agency hiring process, especially when it comes to attracting qualified applicants. Just 40% of respondents believe their organization is competitive with the private sector in its ability to recruit and hire talent. Even more troubling, this figure drops 22 points when examining state government employees specifically: only 18% say their organizations are competitive with the private sector.

Several respondents provided input on this topic, including some noting that it is “hard to attract professionals” for rural or suburban government jobs, due to “isolation, lack of urban amenities, and lower wages.” While lower salaries may deter potential recruits from public service, benefits packages appear to measure up to those in the private sector. 70% of respondents believe their organization’s benefits and ‘job perks’ are at least on par with the private sector.

In addition to the above, some organizations also have room for improvement when it comes to workforce diversity and representation. One in three respondents disagrees that their organization is as diverse as the citizens it serves. Surveytakers cite even larger gaps higher up, with nearly half of respondents reporting representational disparities among their organization’s leadership.

"There is much to do, and we lack the resources to do it all.”

Respondents rank the budget planning process as the second most challenging issue facing their organizations, with nearly one quarter considering it to be their agency’s top challenge.

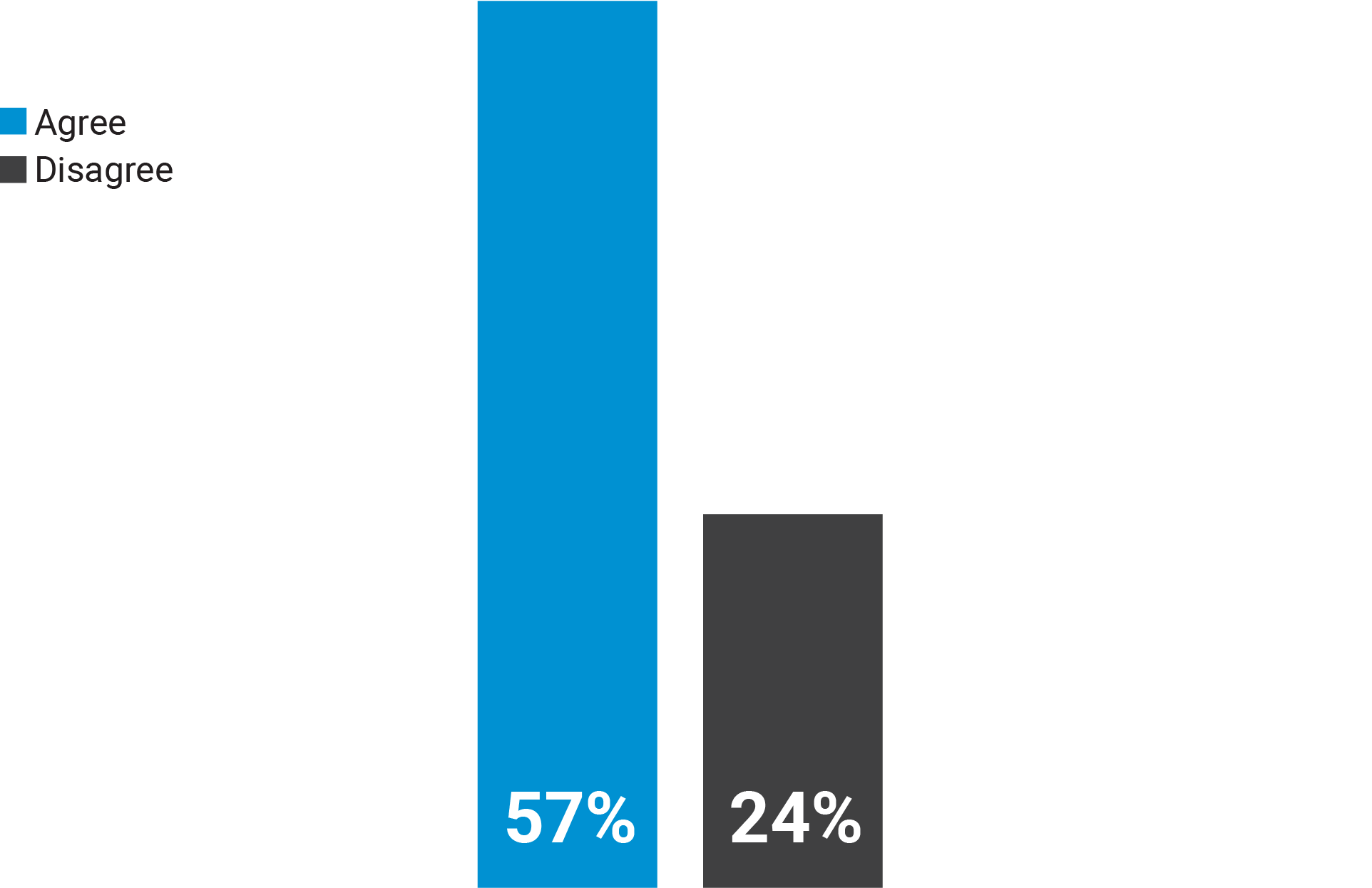

When asked about funding and grants, 57% of respondents feel their organizations encounter more red tape than in the past. Additionally, a common theme stressed in respondents’ open-ended remarks is that agencies today have to do more with less. One respondent notes, “There is much to do, and we lack the resources to do it all,” while others bemoan the demanding toll of new but unfunded federal mandates.

The budgeting process is made even more unwieldy as some state and local leaders are forced to make spending choices with limited information. Half (53%) of respondents believe their organization has accurate and complete performance data with which to make budget decisions, a number that drops to 41% when asked of those employed in Executive Offices.

The combined strain on resources and insufficient data may have negatively impacted several organizations: one fifth of respondents say their organizations have been unable to maintain their effectiveness in light of budget cuts.

IT/technology management, including modernization and implementation, ranks as the third most challenging area in the study. Fourteen percent of survey takers consider this to be their organization’s number one challenge, with respondents most concerned about the ability to procure new technologies and hire for IT skills and talent.

"Tight budgets also make it difficult to implement technology and software-based solutions that could help manage work product and flow.”

Just 43% of respondents believe their organization has the budget to sufficiently invest in IT modernization, a percentage that decreases to 33% among those who identify IT/technology management as their organization’s top management challenge.

Only 48% of respondents believe their organization is effective at recruiting employees with appropriate IT skills and expertise.

Respondents rank collaboration (both internally and with other organizations) as the fourth most challenging issue. Working across teams and stakeholders still continues to be a daunting task for many respondents: 79% consider collaboration to be challenging in their organization.

Though they find it challenging, the vast majority of respondents are optimistic about how their their coworkers and organizations approach collaboration. For instance, an overwhelming 81% say that their organization’s subdivisions and departments can be described as collaborative with one another. 77% of respondents say their organization is receptive to trying out new ideas and methods utilized by other government organizations, and the same percentage say their organization often collaborates with other agencies to tackle complex challenges.

48 out of the 49 police and law enforcement workers surveyed describe their organizations as collaborative.

The greatest obstacles to collaboration appear to be confined to individual agencies rather than being systematic. One fifth of respondents say their organization’s subdivisions are not collaborative, are not receptive to trying out new ideas utilized by other government organizations, and do not often collaborate with other agencies. Many of these respondents comprise the 13% who indicate collaboration is their organization’s top management issue. Elaborating on their concerns, some respondents noted the lack of a culture that rewards collaboration, as well as conflicts of interest between elected officials and career employees.

"Collaboration is desperately needed to meet many of our targets, but historically has not been rewarded -- so it's not behavior that comes naturally.”

Although a lower ranked issue overall, 76% of state and local employees consider data-driven decision making to be challenging, and 10% of respondents rank it as their organization’s number one issue.

A majority of respondents respond positively when asked how their organizations currently utilize and share data. 76% agree that their organization is always looking for ways to make better use of the data they collect. Similarly, 83% of respondents believe their organization prioritizes being open and transparent with data.

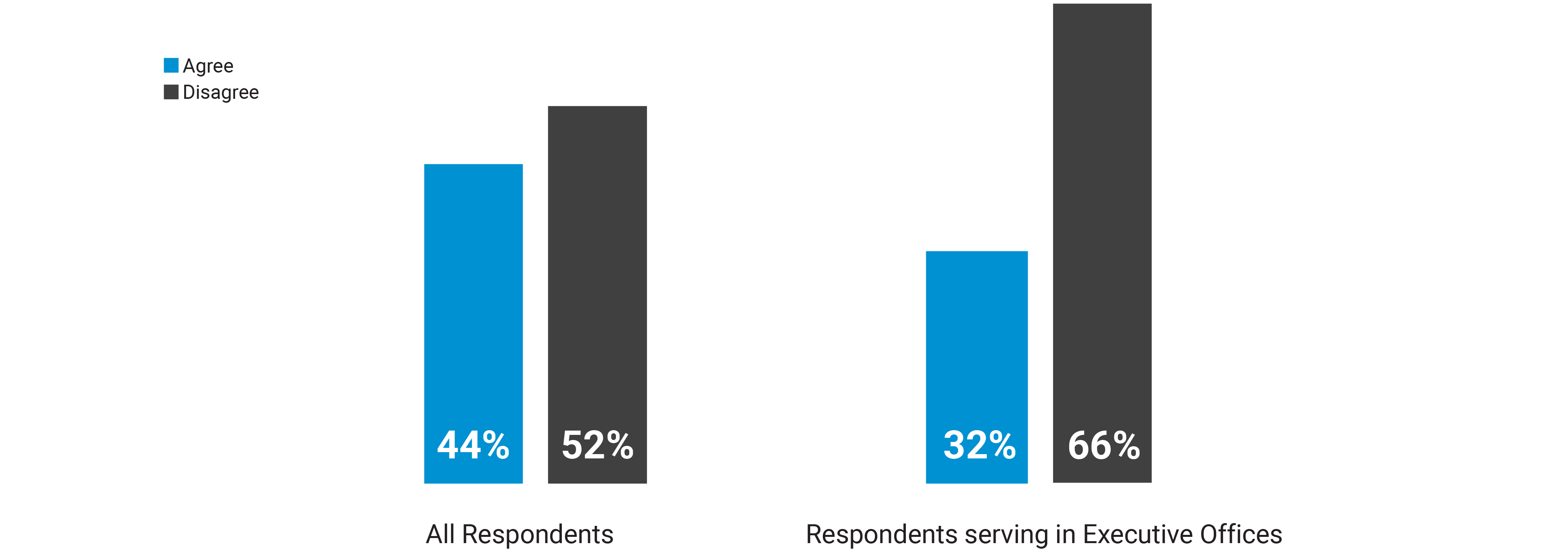

However, respondents recognize difficulties in equipping workers to leverage this data, with only 44% saying they believe employees at their organization have the training needed to make data-based decisions. These struggles may be further compounded by the inconsistent availability of data discussed earlier as part of the budget planning process.

"Without the proper integration of technology in the decision-making process, data-driven decisions are difficult to achieve.”

Only 2% of respondents in the study say acquisition and procurement is their organization’s number one challenge. However, 66% of respondents still indicate that this area is challenging for them.

76% of respondents say their organization is able to acquire needed products and services in a timely manner, 75% believe that their organization has a wide range of vendor options from which to select the best choice, and 74% agree that they are able to hold their contractors accountable to deadlines and quality. However, many respondents report difficulties in technology procurement, largely due to deficits in both budget and in-house IT expertise.

"When developing RFPs for new IT, it’s hard to identify technology that has 'staying power' to avoid becoming obsolete shortly after implementation."

Despite widespread optimism, perhaps due to the stabilizing of budgetary conditions in many parts of the country, Route Fifty’s 2016 Top Management Challenges for State & Local Government report identifies a number of obstacles facing state and local government employees. Addressing workforce needs, budgeting for IT updates, and better equipping employees to make decisions using data are just some of the challenges organizations will look tackle in the coming months. Join us as Route Fifty covers these topics in 2016 and uncovers how states and localities are facing these issues head on.

Route Fifty and Government Business Council released a survey on October 20, 2015 to Route Fifty subscribers and other state and local government leaders. 928 respondents participated in the survey, which has a 4% margin of error. Of the respondents, 16% are state government employees and 84% are local, county, municipal or township government employees.

To rank the management challenges, respondents were asked: “Which of the following represent the greatest management challenges for your organization? Please rank the following list from most challenging to least challenging. Only rank the items you consider challenges.” Respondents were also asked to agree or disagree with follow-up statements on several subtopics across each issue area.

Full data and survey questionnaire can be found here.

The 928 survey respondents represent all 50 states, the District of Columbia, and other U.S. territories.

Current Employment

| State government | 16% |

| County or county equivalent (e.g., consolidated city-county) | 22% |

| Municipal government (e.g., incorporated city, town, village) | 57% |

| Township government | 4% |

| Independent special district government (e.g., utility, fire, police, transit) | 0.3% |

Respondent Role/Rank

| C-suite/ executive level | 51% |

| VP/senior level | 29% |

| Mid-level | 19% |

| Entry/junior level | 1% |

Oversees/Reports

| None | 8% |

| 1-5 | 23% |

| 6-20 | 23% |

| 21-50 | 17% |

| 51-200 | 18% |

| Over 200 | 11% |

Years Serving Government

| 5 years or fewer | 11% |

| 6 to 10 years | 11% |

| 11 to 20 years | 24% |

| 21 to 30 years | 26% |

| 31 to 40 years | 22% |

| Over 40 years | 4% |

Region

| Northeast | 14% |

| South | 28% |

| Midwest | 27% |

| West | 30% |

| Other (e.g., Guam, other U.S. territories) | 1% |

Mission Areas Represented

Listed in order of frequency:

• Community Planning & Development

• Executive Offices

• Finance and Budget

• Police/Law Enforcement

• Transportation/ Infrastructure

• Energy and Utilities (Public Works)

• Tax and Revenue

• Legislative/Policy

• Healthcare and Human Services

• Libraries

• Parks & Recreation

• Environment and Natural Resources

• Fire/EMS

• Justice/Courts

• Public Affairs/Communications

• Education

• Housing and Urban Development

• Emergency Preparedness

• Labor Relations

• Agriculture and Food

• Information Technology

• Social Services/Child Protective Services

• Commerce

• Corrections/Prisons

• Elections

• Waste Management

• Alcohol/Tobacco/Firearms Regulation

• Lottery & Games

• Other

*Percentage of respondents, n=928

Note: Percentages may not add up to 100% due to rounding.

Government Business Council

As Government Executive Media Group's research division, Government Business Council (GBC) is dedicated to advancing the business of government through analysis, insight and analytical independence. As an extension of Government Executive's 40 years of exemplary editorial standards and a commitment to the highest ethical values, GBC studies influential decision makers from across government to produce intelligence-based research and analysis. www.govexec.com/insights

Report Author: Mark Lee

Contributors: Brittany Rouiller, Rina Li

Underwritten by: Grant Thornton

Grant Thornton is pleased to support this research. Grant Thornton’s Global Public Sector helps executives at all levels of government maximize their performance and efficiency in the face of ever tightening budgets and increased demand for services. Our in-depth understanding of government operations and guiding legislation represents a distinct benefit to our clients. We give clients creative, cost effective solutions that enhance their acquisition, financial, human capital, information technology, and performance management.