Connecting state and local government leaders

Economists have been debating the merits of the minimum wage for more than a century.

Economics suggests the minimum wage is a bad idea.

The job market, according to elementary economics, is like any other market. It works best if wages are set by supply and demand, not by any other factor, like government rules. Just as the government doesn’t set a minimum price for shirts or avocados, so they should not be telling employers the lowest amount they can pay workers.

Standard economic theory says a government-enforced minimum wage risks the loss of jobs, as there could be some employers only be willing to hire workers at a wage below the minimum, and some workers without jobs who would take one that pays below that minimum. By mandating a minimum wage, the government is harming both employers and workers, and hurting the economy’s productivity to boot.

Yet when a recent study found that a sharp rise in the minimum wage in Seattle led to job losses and fewer hours for low-wage workers—exactly what supply and demand theory would predict—it led to a vociferous debate within the economics profession. The primarily complaints of those who found fault with the research was that certain types of workers who may have benefitted from the wage rise were excluded from the analysis.

The minimum wage has become a battleground for economists. Thomas Leonard of Princeton writes in his excellent history (pdf) of the minimum wage, The Very Idea of Applying Economics: The Modern Minimum-Wage Controversy and Its Antecedents, that the amount of energy that goes into minimum-wage arguments vastly outstrips it’s importance as a policy matter. Issues like the design of health insurance, tax policy, and entitlement reform are more important policy issues, he says, but don’t inspire nearly the level of rancor—less than 2% of American workers received wages at or below the federal minimum in 2016.

Leonard believes the minimum wage generates so much angst because it goes right to the heart of how one views free markets. If the minimum wage is good policy, it upends all of orthodox economic theory.

Start at the Beginning

The minimum wage’s origins are traced to workers’ movements in industrializing nations in the 19th century. Long hours, low wages, and lack of safety led unions and social reformers to advocate for a variety of laws to protect factory workers. The first minimum-wage laws, which appeared in the 1890s in New Zealand and Australia, and the 1900s in the United Kingdom, were not national wage minimums, like there is today in the US, but minimums for specific industries where there were concerns that workers were being taken advantage of.

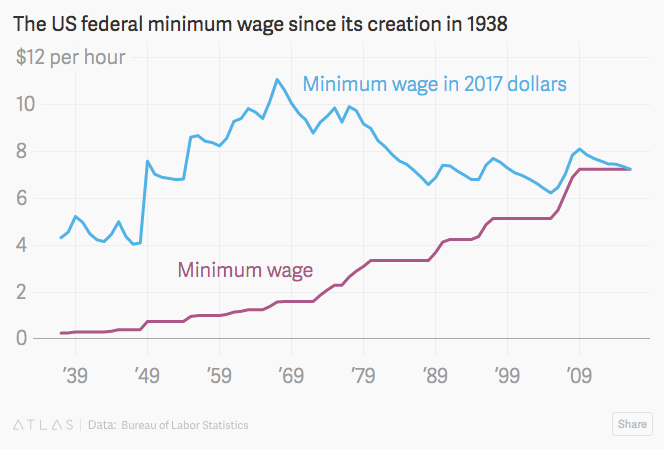

The minimum wage arrived in the US in the 1910s, but only in some states, and only for women and children. “Until the advent of a [US] federal minimum in 1938, men were deemed outside such paternal protection, in light of the U.S. Constitution’s explicit protection of the right to free contract,” Leonard explains. The US set a minimum wage in of 25 cents per hour in 1938, and has raised it intermittently since (it is not tied to inflation).

From the start, it was clear the minimum wage would be a test for economic theory. “The working of this virtual fixing of a minimum wage will be watched with interest by economists,” wrote economists Beatrice and Sidney Webb in their 1897 book Industrial Democracy. (The Webbs, a married couple, were among the founders of the London School of Economics.)

Though economists debated the merits of the minimum wage throughout the 20th century, serious empirical analysis of the issue did not appear until the 1970s, writes Leonard. At that point, economists began analyzing the impact of the minimum wage by statistically examining what happened to jobs across time when the minimum wage increased. These researchers generally found that a wage minimum removed some jobs from the economy, though they disagreed about how many.

By the 1980s, it was generally accepted that the minimum wage had a negative impact on employment. A poll of graduate students at top economics programs in the US in 1987 showed that more than 70% agreed that the minimum wage “increases unemployment among young and unskilled workers,” versus 18% who disagreed and 9% who didn’t have an opinion.

On Second Thought…

A turning point in the minimum-wage debate came in 1993 when David Card and Alan Kreuger, economists at Princeton at that time, published the paper “Minimum Wages and Employment: A Case Study of the Fast-Food Industry in New Jersey and Pennsylvania.” The research examined the impact of New Jersey’s minimum wage increase from $4.25 to $5.05. They compared the labor market outcomes for New Jersey’s fast-food workers with nearby fast-food workers in Eastern Pennsylvania, where the minimum wage was not raised. They found no difference between them.

Card and Kreuger went on to publish the seminal book Myth and Measurement: The New Economics of the Minimum Wage, in which they made a full-throated defense of setting a wage floor. They find that the results from natural experiments, like their New Jersey study, did not show hikes to the minimum wage leading to a fall in employment. In fact, they claimed, a number of studies showed that the minimum wage had a positive effect on employment. Earlier research, they argue, was flawed because it relied statistical techniques that poorly isolated the effect of the minimum wage compared to other factors.

Some economists were appalled by Card and Kreuger’s stance. Leonard points out that the Nobel Prize-winning economist James Buchanan wrote the following in a 1996 Wall Street Journal op-ed:

Just as no physicist would claim that “water runs uphill,” no self respecting economist would claim that increases in the minimum wage increase employment. Such a claim, if seriously advanced, becomes equivalent to a denial that there is even minimal scientific content in economics, and that, in consequence, economists can do nothing but write as advocates for ideological interests.

How do Card and Kreuger explain this invalidation of long-held economic theory? They argue that the minimum wage’s beneficial effects are a result of an economic phenomenon called “monopsony.” Labor markets don’t operate like commodity markets, Card and Kreuger explain (pdf). It isn’t true that companies have to pay the prevailing price for labor, like if they were buying corn or stocks. Rather, to some degree, they are able to set the price for labor; in a monopsony, there is one buyer (an employer) that sets terms for sellers (prospective workers).

As a result of this price-setting power, a car factory might end up in a situation where all of its workers are making $7 an hour, but the only way the plant can attract new workers is by offering $8 an hour. If they gave those new workers $8 an hour, it would be hard to avoid also paying $8 to existing workers, given the risk of disruption. So instead of hiring new people, the plant may decide it’s more profitable to keep paying $7 and remain understaffed. Card and Kreuger argue that, in this case, moving the minimum wage to $8 would increase employment, so long as the company remains profitable.

Point and Counterpoint

It has been two decades since Card and Kreuger originally made their pro-minimum wage argument, and they stick by it today. As recently as October 2015, Kreuger wrote in the New York Times that raising the US minimum wage to $12 per hour by 2020, from $7.25 today, would do more good than harm. The economists’ position is no longer unusual. A 2012 joint report (pdf) by the World Bank, IMF, and OECD recommended that governments set a minimum wage.

Still, the debate rages on in the economics world. Card and Kreuger’s work has been challenged on grounds both methodological (their data was unreliable and short-term) and theoretical (many economists find their monopsony explanation unconvincing).

Wading through assessments of the impact of the minimum wage is a dizzying experience. For every study by respected economists that clearly shows harmful effects, there is another that shows the exact opposite (pdf). In the case of the recent Seattle study, there was another study that came out around the same time that suggested the increase didn’t impact employment at all. All economists seem to agree on is that there is some limit to how high the minimum wage can go without causing serious damage—besides that, it’s hard to know what to believe.

One common misconception about the argument is that economists in favor of the minimum wage are pro poor, and those that don’t support it are pro unfettered capitalism. In fact, many economists who are not in favor of significant hikes to the minimum wage are in favor of other policies they believe help the poor without distorting markets.

For example, one popular idea is increasing the earned income tax credit, a credit offered to low-income workers. In 2015, the credit was received by 27 million households, at an average amount of $2,455. Economists like the University of California, Irvine’s David Neumarkand my colleague Allison Schrager support boosting this credit rather than the minimum wage. Neumark and Schrager are from a long line of economists concerned about how free markets for labor impact the poor, but question whether the minimum wage is the best tool to address those issues. For example, Leonard points out, all the way back in 1848 philosopher John Stuart Mill expressed concern about whether a minimum wage would best achieve progressive ends.

A Pew Research poll shows that the majority of Americans support raising the minimum wage to $15 an hour, and the policy has Democratic party support. Cities across the US, like Seattle, are hiking wages. Many more years of conflicting study results and methodological criticism is ahead of us.

Dan Kopf is a reporter for Quartz, where this article was originally published.

NEXT STORY: More Employers May Be Using Temps to Skirt Immigration Laws