Connecting state and local government leaders

The idea is to encourage people to build up their savings by enrolling them in lotteries to win prizes. But that hasn't necessarily drawn people to sign up.

More states are allowing banks and credit unions to entice customers to build up their savings by offering them lottery-like prizes. But even with a chance to win money, most customers still aren’t saving.

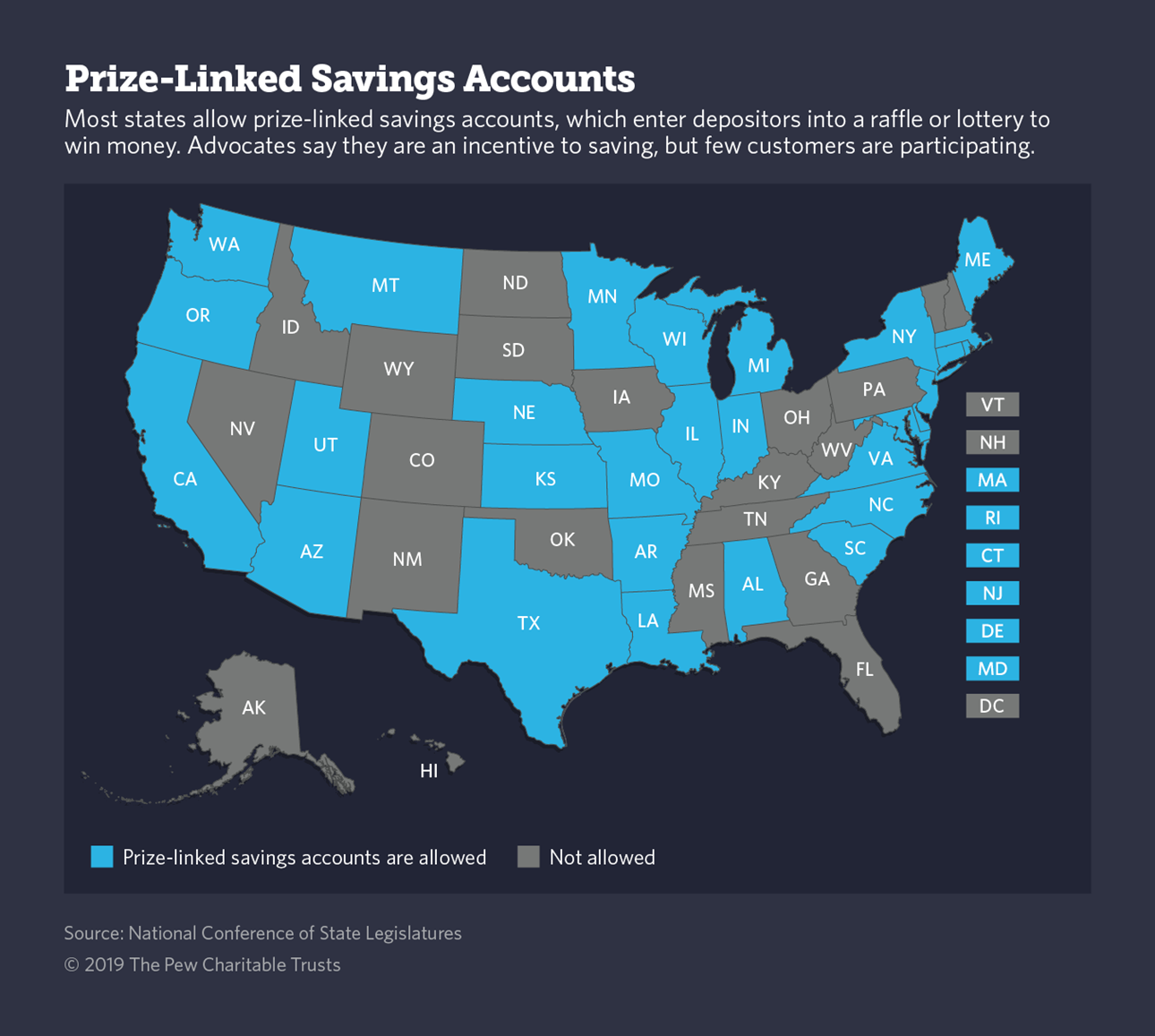

Twenty-nine states now permit credit unions or banks to offer “prize-linked” savings accounts, according to the National Conference of State Legislatures. This year, Utah enacted a law and Georgia passed a measure that awaits the governor’s signature. The accounts look a little like a lottery or a raffle, and that’s not by coincidence: They are designed to attract low-income people who are not regular savers, but who play the lottery in disproportionate numbers.

The savings accounts pay little interest, but every time you deposit a certain amount ($25 in most cases), you become eligible to win prizes. The prizes—up to $10,000 in some states—are a lot bigger than the toaster or other small appliances linked to savings accounts in bygone years, but a lot less than the multimillion-dollar lottery jackpots.

Michigan piloted “Save to Win” accounts in 2009. Nebraska, North Carolina and Washington followed suit in 2013. Congress in 2014 passed the American Savings Promotion Act, removing the restriction that barred federally chartered banks from offering prize-linked savings accounts. That prompted more states to take the legislative action necessary to legalize them.

But so far, few people are interested in signing up. A 2018 study of programs in Michigan and Minnesota by the Pew Charitable Trusts (Pew also funds Stateline) found that while 17% of Michigan credit union members had access to “Save to Win” accounts in 2013, only 1.3% of those members actually opened one. The rate was similar at the two Minnesota financial institutions Pew studied.

Brian Gilmore, senior innovation manager at Commonwealth, a Boston-based nonprofit that promotes prize-linked savings nationwide and designed Michigan’s program, said the Pew study covered the early years of the program, and that participation may be higher now. He suggested that some customers might be put off by a withdrawal limit, typically once or twice a month.

But Gilmore also noted that Commonwealth’s research shows that between 11% and 19% of prize-linked account holders said they joined the credit unions for the prize accounts, which indicates that they hold some appeal.

Joseph Nathan Cohen, an associate professor of sociology at CUNY Queens College and an expert in household savings, said people may be reluctant to sign up for prize-linked accounts for the same reason they don’t save generally: Those in the bottom-fifth of the income distribution don’t have enough money to even consider savings.

Cohen also cited the restrictions on how often the money can be withdrawn and a lack of advertising. “An unbanked person has very low income and not much in the way of assets,” he said by telephone. “I don’t see why they would lock up a very scarce resource.”

Financial institutions tout the accounts as a “no lose” proposition, since your savings are still in the accounts even if you don’t win prizes. Low interest rates on ordinary savings accounts also make the prize-linked accounts, which are also called “Lucky Savers” and “Lucky Lagniappe,” more attractive.

Most of the accounts have interest rates in the same range as regular savings accounts or 12-month certificates of deposit.

“It’s pretty appropriate to think of them as appealing to consumers’ interest in lottery-like products,” said Melissa Kearney, an economics professor at the University of Maryland who has studied prize-linked accounts.

“The expected return is positive, which makes them a better return than lottery tickets. Evidence suggests this is appealing to people and it will pull people into savings that might otherwise have been gambling or buying lottery tickets instead.”

Modern Americans just don’t save. According to Prosperity Now, a progressive group that tracks income and wealth data, only 58% of U.S. households save for emergencies.

And the Federal Deposit Insurance Corporation, using 2016 data, reported nearly a quarter of American households did not have even $400 in easily accessible savings.

The most recent high in the savings rate for American households was 17.3% in May 1975, according to a Federal Reserve Bank of St. Louis study. In March, the rate was 6.5%, the St. Louis Fed reported. Economists blame the easy availability of credit for some of the decline, along with the higher cost of necessities like housing and health care.

Commonwealth and the Federal Reserve Bank of Boston have tried to identify other ways to incentivize savings. In addition to prize-linked accounts, they held a seminar to discuss best practices in 2017 a cited a program under which a bank gave $5 to every local third-grader in 2008.

Ten years later, the report said, among households where a child received the money, the bank saw a 60% increase in customers using their banking services, an 80% increase in deposit balances and a 60% increase in loan balances.

Vermont state Rep. Matt Hill, a Democrat, is sponsoring legislation in his state that would allow both credit unions and banks to offer prize-linked accounts. He said his primary goal is to reach the “unbanked” population—people with no connection to a bank or other financial institution.

“In Vermont, like the rest of the country, there’s a very large number of people who don’t have a savings account,” he said in a phone interview. “If they encounter a $400 car bill, if something else comes up, they don’t have money to cover a situation. I thought it would be a good way to encourage them to build up a savings fund to get them through a month if they need to.”

In 2017, the most recent year for which data is available, 6.5%, or 8.4 million U.S. households did not have a savings or checking account, according to the FDIC. An additional 18.7% of households were “underbanked,” meaning they had a bank account but also used financial services outside of the banking system, from storefront lenders to credit agencies.

Virginia began allowing prize-linked accounts for both banks and credit unions in 2015, but some financial institutions there are just now offering them.

Amanda Habansky, chief operating officer at Peoples Advantage Federal Credit Union in Petersburg, Virginia, said only 20 union members have signed up for the accounts so far, but that may be because Peoples Advantage hasn’t done a lot of advertising.

“Some of the money has been moved over from other savings accounts, some has come from other financial institutions. Some has come from direct deposit, and it’s money that would have gone out the door or to the real lottery,” Habansky said. “Instead, we’re creating a savings habit.”

NEXT STORY: A State Reconsiders Its Ban on Local Minimum Wage Laws