As States Plan for Next Year’s Budget, the Economy Flashes Mixed Signals

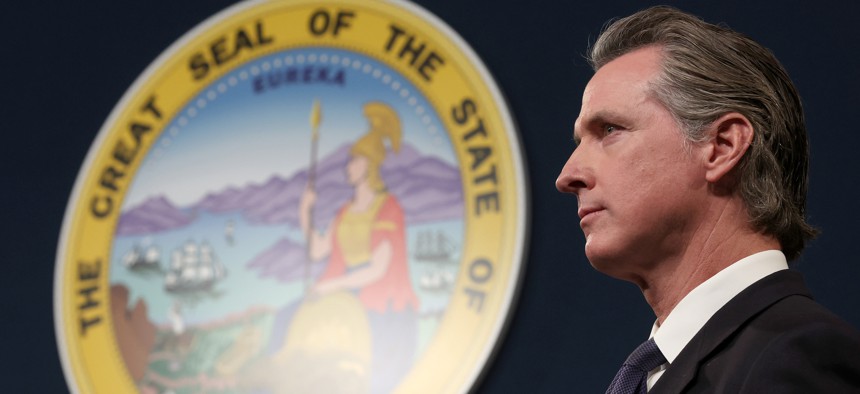

California Gov. Gavin Newsom’s proposed spending plan assumes the state will face a $22.5 billion budget shortfall over the next three years. Justin Sullivan via Getty Images

Connecting state and local government leaders

Even with rising inflation and worries about a looming recession, most state budgets are doing better than expected. But there are signs that the slowdown policymakers keep planning for is getting closer.

You're reading Route Fifty's Public Finance Update. To get the latest on state and local budgets, taxes and other financial matters, you can subscribe here to get this update in your inbox twice each month. You can find a full archive of these newsletters here.

Welcome back to Route Fifty’s Public Finance Update! I’m Liz Farmer, back from vacation, and this week I’m doing a state budgets update.

With just a few months left in most states’ fiscal year and a looming deadline to pass next year’s budget, the spring months can be a bit of a juggling act for lawmakers if the current year’s revenues aren’t lining up with expectations.

The key word here is expectations. And many states have dialed them down compared with what they experienced in fiscal 2022.

“These last few years have been very unique—it’s unprecedented to see double-digit revenue growth for two straight years,” said Brian Sigritz, director of state fiscal studies for the National Association of State Budget Officers (NASBO). “Some of that was economic strength, and some of it was due to the federal funding flowing to states and households. States weren’t assuming that level of growth would continue.”

But it did. Halfway through the fiscal year, most places were still seeing a steady rise in revenue powered largely by a tight labor market and consumer spending driving up sales tax revenues. Midyear budget forecasts in many states revised their revenue expectations up, more closely matching 2022’s totals.

And still, even with rising inflation and worries about a possible recession, most state budgets are doing better than expected. Places that have traditionally struggled to balance budgets seem to be cruising. Illinois, for example, is estimated to collect nearly $5.5 billion more in total revenue than what was initially budgeted.

But there are signs that the slowdown policymakers keep planning for is getting closer. Recent data from the Urban Institute indicates that state revenue growth, when adjusted for inflation, has started to stall. While sales tax revenue growth has remained strong, income tax revenue is sliding more than expected. Moreover, since the start of this year, the stock market has fallen roughly 5%, tech companies have laid off thousands of workers and the ramifications of Silicon Valley Bank’s collapse are still playing out.

Now, a more mixed picture of state fiscal health is starting to emerge as some states are managing shortfalls even as others report record surpluses.

“Either the economic storm clouds have parted,” opined Oregon’s latest budget forecast, “or we are in the eye of the hurricane.”

Deficits and Surpluses

Preliminary data compiled by the Urban Institute’s Lucy Dadayan show that inflation-adjusted state tax revenues declined during the first seven months of fiscal 2023 (July 2022 through January 2023) compared with the corresponding time period the year before. The median decline was 2.8% while the median drop in personal income tax revenues was 6.9%. Corporate income taxes rose while sales tax revenue inched slightly downward.

“Income tax from [wage] withholding is very weak across all states, which shows me wages are not keeping up with inflation,” Dadayan said. “And the states with more progressive income tax structures and reliance on high income are seeing the biggest declines.”

But only in a few states are the declines translating into budget gaps and California is dealing with the largest gap. Lawmakers there budgeted for a roughly $10 billion decrease in revenue this fiscal year—but the actual drop has been more than twice as much, according to the state’s budget forecast report last fall.

Gov. Gavin Newsom’s proposed spending plan assumes the state will face a $22.5 billion budget shortfall over the next three years. He is not planning to dip into the state’s more than $35 billion in reserve funds to cover it, though. Instead, his plan calls for finding savings such as delaying $134 million in funding for 20,000 new child care slots and reducing first-time homebuyers assistance from $500 million to $300 million.

Other states are dealing with more modest drops from expected revenue. Maryland, which had assumed revenue growth this year is now estimating a $478 million dip across the current and next fiscal year. The decline in revenue estimates is due to a sharp drop in sales and income taxes. It means Maryland’s total revenue growth for fiscal 2023 will be around 2% and next year’s growth is expected to slow to 1%.

"We are experiencing a new walking speed, if you will, for our economy, and we have yet to fully define what that walking speed is," Maryland Comptroller Brooke Lierman told local reporters in March.

Delaware is also seeing a significant drop in personal income tax revenue and has shaved $80 million off its expected revenue collections for this year. But total revenue is still projected to be nearly 6% higher than in 2022.

Washington state’s chief economist recently announced revenue collections for the current two-year budget cycle will be $483 million lower than previously projected. The projection represents about a 0.7% drop from the number forecast in late 2022.

Still, most states are riding high and reporting surpluses. Many of these states don’t have an income tax or a flat income tax. That makes them less sensitive to changes in earnings from higher-income households, which tends to drive fluctuations in states like California that have higher tax rates for the wealthy.

Texas, which operates on a two-year budget cycle, now estimates revenue for the 2022-23 biennium will hit $149 billion—nearly $33 billion higher than expected.

Colorado, Illinois, Minnesota, New Jersey, North Carolina, North Dakota, Oregon and Wisconsin are some of the other states reporting significant budget surpluses due to higher-than-anticipated revenue.

Getting Ready for 2024

As states look to wind down their budgeting season, the largely rosier forecasts this year aren’t leading to any new sweeping spending proposals that weren’t already in the picture. For the most part, said Sigritz, state budget proposals assume slower revenue growth next year.

Interestingly, though, tax breaks continue to have widespread interest even after 29 states passed major tax cuts in 2021 and 35 states did so in 2022.

Sigritz and Dadayan said most states will have a better picture of what to expect in 2024 after the income tax filing season ends in April.

Given the latest revenue figures, Dadayan sees storm clouds gathering and warns that the years of surpluses may soon come to an end.

“States have healthy rainy day balances and will be able to weather the crisis,” she said. “But I always think no matter how big your rainy day fund is, you shouldn’t be enacting changes that dramatically reduce revenues without thinking about how you’re going to make that up elsewhere in the budget.”

NEXT STORY: State & Local Roundup: The ESG Debate Hits a New Frenzy