The States That Could Be Derailed By an Economic Downturn

The Louisiana state capitol building in Baton Rouge. Shutterstock

New research shows that some states have improved their ability to cope with a recession. Others remain less prepared.

CHICAGO — There’s a divide among states when it comes to how well they’re prepared for the next recession, according to research released Monday.

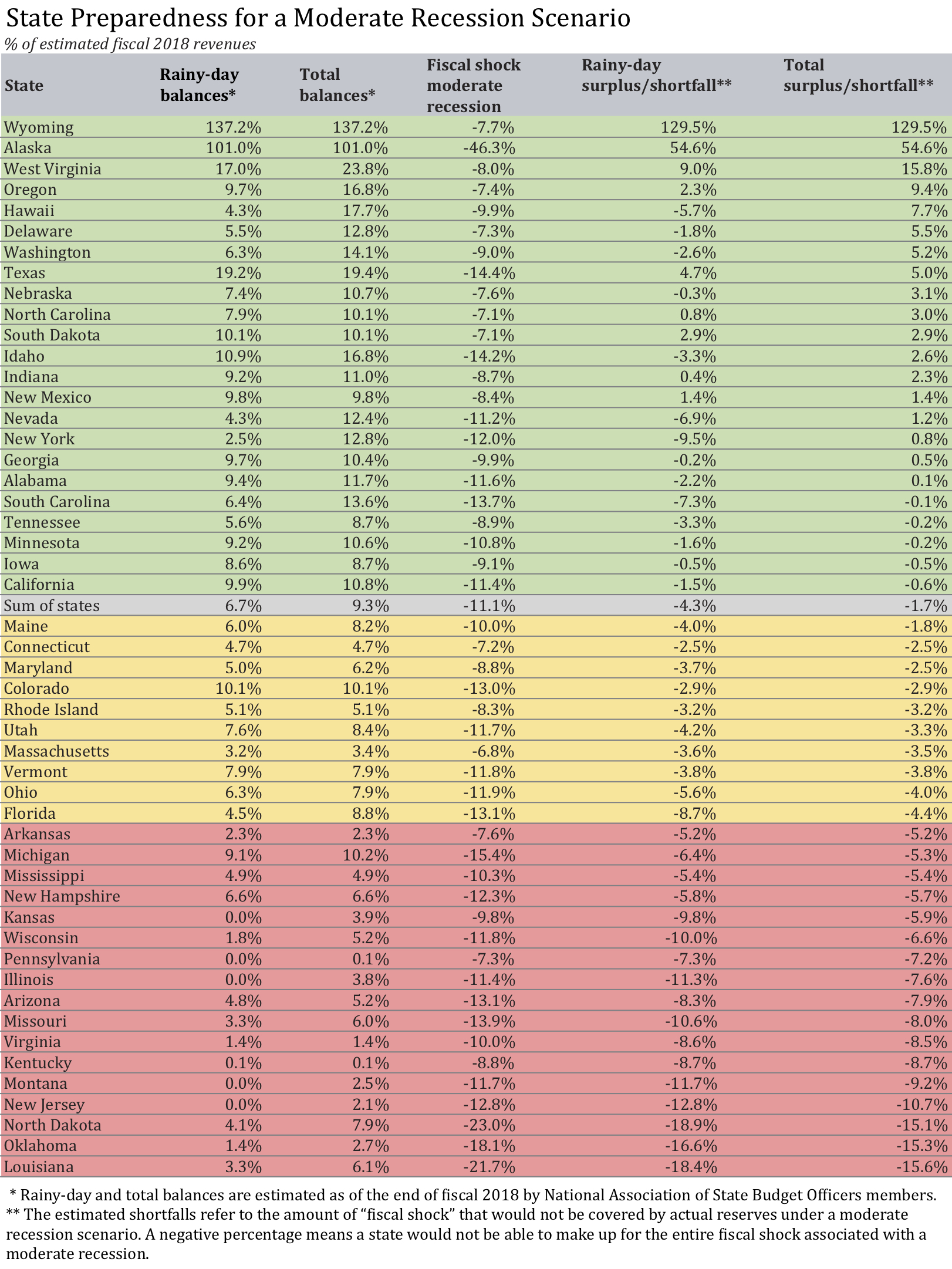

Moody’s Analytics found in a “stress test” exercise that 23 states have the funds on hand that they need to weather a moderate recession without having to raise taxes or cut spending. That's an improvement over last year when the same figure was 16.

But another 17 states are significantly unprepared for even a small downturn, based on the new analysis.

“It’s very scary for those states,” Dan White, director of government consulting and public finance research at Moody’s Analytics, and one of the people who oversaw the project, said at an event in Chicago.

Inadequate savings can force state policymakers to make tough budget decisions during a downturn. But White said this is not the only reason to be concerned, pointing to the implications for how state economies are positioned to recover from a recession.

“From my perspective,” he said, “this is a very dangerous thing.”

“If you’re in a race to get the next Tesla to come to your state in 2021, are you going to have the cash on hand to be able to offer them the tax incentives?” he asked. “Are you going to have the infrastructure? Are you going to be able to invest in higher education?”

Also on Monday, the ratings agency S&P Global Ratings released a report that said only 20 states have sufficient reserves to absorb “the first-year fiscal shock” from a recession.

S&P says states' fiscal year 2019 budgets include about $715 billion in primary general fund tax revenues, such as personal income tax, corporate tax and sales tax revenues. If a recession occurs, the ratings agency estimates in its report that states could experience a shortfall of $71.1 billion, or 9.9 percent.

Moody’s describes the overall results of its stress test as “unmistakably positive” compared to last year and says states as a whole have never been more prepared to confront a sour economy. But it also cautions that “the gap between the haves and have-nots has widened.”

Recessions tend to have a two-fold effect on states. Revenues drop, while spending on government services rises.

Moody’s limited the analysis for its stress testing to considering changes in general fund revenues and spending on Medicaid. Medicaid, the main health insurance program for low-income Americans, represents a significant portion of state spending and is sensitive to slowdowns, when people see earnings fall.

The results of the analysis show that a typical state would need reserves equal to about 11 percent of its general fund revenues in order to offset the “fiscal shock” from a recession, while also avoiding spending cuts or tax hikes. For a severe downturn, like the Great Recession, that figure would rise to nearly 18 percent.

Although Moody’s Analytics (a research arm of Moody’s that is separate from the ratings agency) has a “baseline forecast” that puts the highest odds for the next recession as hitting in mid-2020, the stress testing models a downturn that happens almost immediately.

The 17 states that Moody’s classified as unprepared for a moderate downturn are more than 5 percentage points short of having the savings they’d need to avoid cuts, or tax increases. States that made this list include Louisiana, Oklahoma and North Dakota.

Some of them would need to either raise taxes or cut spending by upwards of 10 percent of their entire budget if a recession unfolded this year, according to the report.

At the other end of the spectrum, states with beefier balances included Wyoming, Alaska and West Virginia, places with economies and state budgets that have long been intertwined with mining and oil and gas production and the ups and downs of the energy sector.

Of the roughly $78 billion in balances states were estimated to have on hand at the end of fiscal 2018, Moody's says the top 23 states held the bulk—$60 billion. But not all of that money was in “rainy day” funds. Some was in other accounts, the result of unanticipated revenues, or spending levels that ended up being lower than planned.

Lawmakers can run into complications when trying to use money that is not part of a rainy day fund to counteract a downturn. “There is also risk that policymakers may appropriate some of those balances for other purposes before the next recession,” the Moody’s report notes.

It adds that it’s unlikely lawmakers would turn to savings alone to get through a recession, without also considering budget cuts, or raising new revenues.

White and his colleagues suggest that even well prepared states have progress to make on two fronts. One has to do with distinguishing between rainy day funds and other balances. The other is having a plan for what to do with reserves when the next recession hits.

As for the states with scant savings or surpluses: “every little bit helps.”

“The economic impact of putting that dollar aside today when the economy is red hot will be much less painful than trying to pull it out of the economy at the height of the next recession,” the report says. “It is never too late to provide your state at least some cushion.”

A full copy of the Moody's research can be found here.

Bill Lucia is a Senior Reporter for Government Executive's Route Fifty and is based in Washington, D.C.

NEXT STORY: In Tax-Free States, Businesses Squirm at Collecting Online Sales Taxes for Others