State Tax Revenue Makes Biggest Gains in Seven Years

The North Dakota Capitol in Bismarck Shutterstock

Connecting state and local government leaders

Revenue collections were boosted by favorable economic conditions, robust stock market returns in 2017 and the first half of 2018, and state policy actions.

This article was originally published by The Pew Charitable Trusts as part of the Fiscal 50: State Trends and Analysis and was written by Barb Rosewicz,Justin Theal & Daniel Newman.

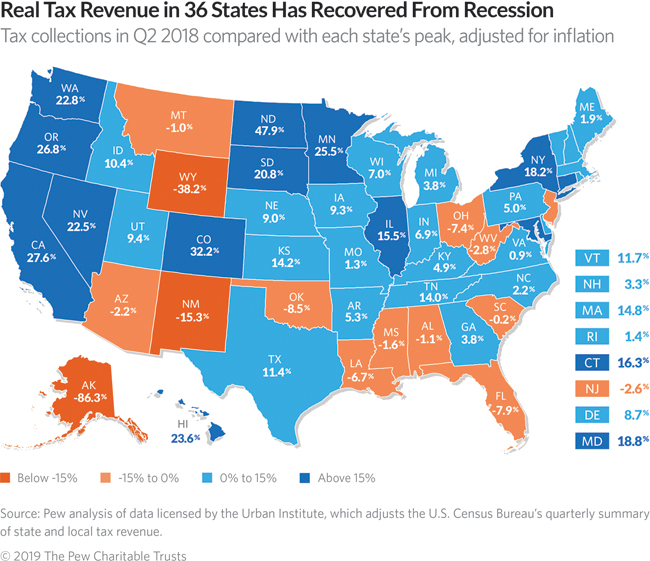

State tax revenue rose sharply in mid-2018 for the third quarter in a row, closing out most states’ budget years with the second-strongest stretch of growth since the Great Recession. At least some of the gains, though, are expected to be temporary. As of the second quarter of 2018, tax collections in 36 states were higher than before receipts plunged in the downturn, after accounting for inflation.

The spike resulted in a turnaround year for many states after they had slogged through the weakest two years of tax revenue growth—outside of a recession—in at least 30 years. Starting in late 2017, the surge propelled total state tax collections to 12.2 percent above the peak recorded in 2008.

The results mean that states collectively had the equivalent of 12.2 cents more in purchasing power in the second quarter of 2018 for every $1 they collected at their recession-era peak, after adjusting for inflation and averaging across four quarters to smooth seasonal fluctuations.

Revenue collections were boosted by favorable economic conditions, robust stock market returns in 2017 and the first half of 2018, and state policy actions. At least a portion of the growth also was due to short-lived effects on state tax revenue from the federal Tax Cuts and Jobs Act.

Besides cutting federal tax rates, the 2017 law included revisions to tax exemptions, deductions, and credits that broadened the income subject to taxation federally and in many states. The result was an automatic increase in tax dollars in many states because of linkages between federal and state income tax codes. At least a dozen states altered their tax laws in 2018 to return portions of the windfall to taxpayers, and more were expected to consider rolling back some of the gains.

The federal changes also incentivized taxpayers to try to lower their federal tax bills by shifting the timing of certain income and payments in ways that resulted in another temporary inflation of state tax collections. Gains in some states also came from a deadline for hedge fund managers to pay taxes on offshore earnings by the end of 2017.

Total state tax revenue rebounded more slowly after the 2007-09 recession than it did after any of the three previous downturns. But trends have varied widely by state. In 13 of the 36 states in which collections had recovered from their recession losses by the second quarter of 2018, tax revenue—and thus purchasing power—was more than 15 percent higher than at its peak before or during the recession. Conversely, collections were down 15 percent or more in three of the 14 states in which tax revenue was still below peak.

As states regain fiscal ground lost in the recession, policymakers face pressure to catch up on investments and spending postponed because of the downturn. That may be more difficult in states where tax revenue remains below its previous peak. But even a return to peak levels can leave states with little extra to cover costs associated with population increases, growth in Medicaid expenses, deferred needs, and accumulated debts and liabilities.

State Highlights

A comparison of tax receipts in the second quarter of 2018 with each state’s peak quarter of revenue before the end of the recession, averaged across four quarters and adjusted for inflation, shows:

- North Dakota remained the leader among all states in tax revenue growth since the recession, although its collections have swung dramatically along with the price of oil during the same period. At the end of 2014, receipts hit a high of 123.9 percent above their peak during the recession, compared with 47.9 percent above in the second quarter of 2018.

- Twelve other states posted tax revenue rebounds of 15 percent or more: Colorado (32.2 percent), California (27.6 percent), Oregon (26.8 percent), Minnesota (25.5 percent), Hawaii (23.6 percent), Washington (22.8 percent), Nevada (22.5 percent), South Dakota (20.8 percent), Maryland (18.8 percent), New York (18.2 percent), Connecticut (16.3 percent), and Illinois (15.5 percent).

- Alaska (-86.3 percent) was furthest below its peak. This means the state collected only about 14 percent as much in inflation-adjusted tax dollars as it did at its short-lived peak in 2008, when a new state oil tax coincided with record-high crude prices. Without personal income or general sales taxes, Alaska is highly dependent on oil-related severance tax revenue, which began falling even before worldwide crude prices declined in 2014 as its oil production waned.

- Two additional states were down more than 15 percent from previous peaks: Wyoming (-38.2 percent) and New Mexico (-15.3 percent).

- Virginia surpassed its pre-recession peak for the first time, taking in 0.9 percent more tax dollars than in the third quarter of 2006.

- Oregon (26.8 percent) exceeded a constitutional cap on tax revenue growth in fiscal 2018, triggering a future refund to taxpayers.

Latest Trends

States collectively took in 5.5 percent more tax revenue from July 2017 through June 2018, the budget year used by most states, than in the previous year, after adjusting for inflation. It was the greatest increase since tax dollars rose 7.0 percent in fiscal 2011. Just two states bucked the upward trend and took in less in fiscal 2018 than they did a year earlier: Mississippi and Ohio. In both, revenue grew but the increase was slower than inflation. Both also have cut tax rates in recent years. Ohio was the only state where collections have declined for multiple quarters in a row, falling in each of the past five.

The improved fiscal conditions eased passage of recent budgets. Thanks to the revenue boom, 40 states—the most in more than a decade—managed to beat their annual revenue projections at the end of fiscal 2018, according to data collected by the National Association of State Budget Officers (NASBO). And only three states failed to enact a spending plan on time for fiscal 2019, compared with 10 states that were late a year earlier.

Overall tax growth in 2018’s second quarter was driven by personal income tax collections, which jumped 7.8 percent compared with a year earlier. That came on the heels of double-digit increases in the previous two quarters, contributing to the fastest stretch of personal income tax growth in nearly five years. In addition to taxpayer behavior that boosted revenue following the federal tax cut, the surge was fed by record-breaking stock market growth, an uptick in wage growth, and historically low unemployment rates. (The stock market later lost all of its gains for 2018 in the second half of the calendar year.)

The other major tax revenue source for most state governments—sales taxes—increased by 3 percent in each of the past two quarters, after adjusting for inflation—the biggest margin since early 2015. However, growth still trailed rates seen in past economic expansions due in part to consumer spending patterns that have been migrating toward services and online purchases that are less likely to be taxed.

In states with significant fossil fuel production, rising energy prices buoyed tax collections. Oil prices rose steadily throughout fiscal 2018 following several years of low prices, pushing many energy-reliant states up from recent tax collection lows. (Oil prices fell again, however, later in the calendar year.)

Looking ahead, the tax revenue boost that most states enjoyed through mid-2018 is expected to moderate given preliminary figures for the third quarter collected by the Urban Institute. Future growth is unlikely to be as strong, as the effects of the federal tax changes will diminish, and economic growth is expected to slow. Stock market volatility along with a global economic slowdown and the impacts of U.S. trade wars will also likely dampen tax revenue growth in upcoming quarters.

Trends Since the Recession

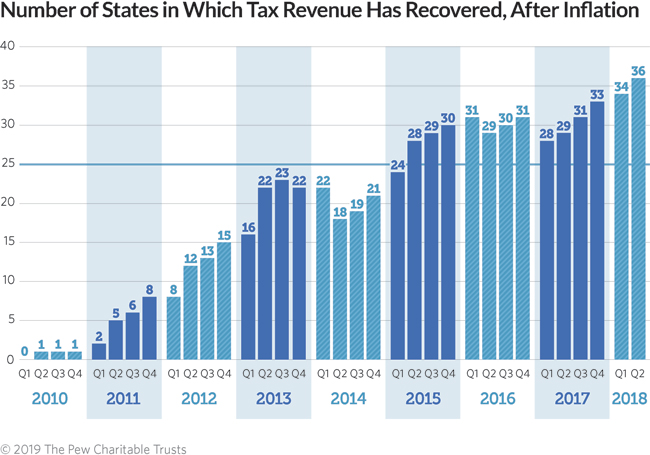

State tax revenue—like the U.S. economy—has grown slowly and unevenly since the recession. Over the past 10 years, the number of states that have regained their tax revenue levels has risen and fallen, reflecting volatility in state tax collections as well as tax policy changes.

Nationally, tax revenue recovered from its losses in mid-2013, after accounting for inflation. But individual state results have differed dramatically depending on economic conditions, population changes, and tax policy choices since the recession. For example, state policymakers have enacted tax cuts in states such as Ohio and North Carolina and hikes in states such as Illinois and Oklahoma since the recession. According to NASBO, states enacted nearly $10 billion in net tax increases for fiscal 2018 following a total of $1.8 billion in hikes over the previous two fiscal years. These increases follow net tax cuts of roughly $2 billion in each of fiscal years 2014 and 2015.

In 2010, North Dakota was the first state to surpass its recession-era peak, followed by Vermont, Illinois, New York, and West Virginia by mid-2011. Tax receipts were above peak in 12 states at the end of fiscal 2012; 22 states at the end of fiscal 2013; 18 states at the end of fiscal 2014; 28 states at the end of fiscal 2015; 29 states at the end of fiscal years 2016 and 2017; and 36 states at the end of fiscal 2018.

State budgets do not adjust revenue for inflation, so tax revenue totals in states’ documents will appear higher than or closer to pre-recession totals. Without adjusting for inflation, 50-state tax revenue was 30.6 percent above peak and tax collections had recovered in 47 states—all except Alaska, New Mexico, and Wyoming—as of the second quarter of 2018. Unadjusted figures do not take into account changes in the price of goods and services.

Adjusting for inflation is just one way to evaluate state tax revenue growth. Different insights would be gained by tracking revenue relative to population growth or state economic output.

Download the data to see individual state trends from the first quarter of 2006 to the second quarter of 2018. Visit The Pew Charitable Trusts’ interactive resource Fiscal 50: State Trends and Analysis to sort and analyze data for other indicators of state fiscal health.

NEXT STORY: States See a Slip in Tax Collections That's Not Totally Unexpected