The New Digital Products and Services Proving Difficult to Tax

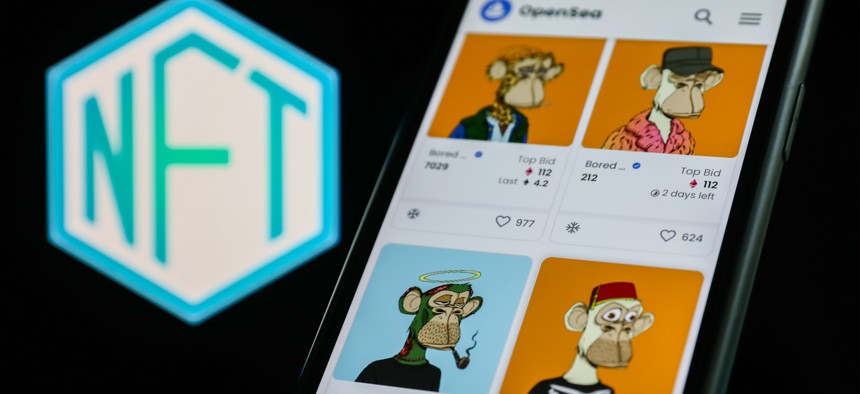

Bored Ape Yacht Club collection in OpenSea displayed on a phone screen and NFT logo displayed on a screen are seen in this illustration photo taken in Krakow, Poland on April 19, 2022. Photo by Jakub Porzycki/NurPhoto via Getty Images

Connecting state and local government leaders

States and localities may have to update policies if they don't want to miss out on revenue.

You're reading Route Fifty's Public Finance Update. To get the latest on state and local budgets, taxes and other financial matters, you can subscribe here to get this update in your inbox twice each month. You can find a full archive of these newsletters here.

Public Finance Update - May 3, 2022

Hi there and welcome to the first edition of Route Fifty's Public Finance Update! I'm Liz Farmer, a fiscal policy writer and expert, and I'll be serving up this newsletter to you twice every month. I've covered fiscal policy for 10 years, state and local governments for even longer, and before my foray into journalism I did a hodgepodge of interesting things, including an archaeological dig in Mexico and a stint at the Discovery Channel networks. My goal with this newsletter is to keep you informed on trends in public finance and to entertain you while doing it. Send feedback and tips anytime to: publicfinanceupdate@routefifty.com.

This week, we look at the difficulties state and local revenue departments face with how to tax a new wave of emerging digital products and services. These offerings tend to blur the lines of traditional tax categories—like communications and software, or financial investment and consumer goods. NFTs, or non-fungible tokens are one example. Many people associate these with the “bored ape” cartoon images celebrities and others have paid top dollar for in recent months. But NFT sales are serious business, totaling around $25 billion last year.

In the past, taxing our digital economy was simply a matter of adapting to changing platforms: an ad is an ad, whether you were holding a newspaper or looking at your computer screen. Whether it’s streaming or on a DVD, a video rental is still an entertainment purchase. But what do you do when you can’t define what a digital product is? That’s a question states and localities are now confronting. And waiting too long to answer it could leave them playing catch up with major shifts in the economy and missing out on revenues in the meantime. It’s reminiscent of the rise of online retail and the lag imposing sales taxes on that sector.

Tax Code Shapeshifters

Non-fungible tokens are arguably causing the most confusion as of late, when it comes to digital taxation. Put simply, NFTs are digital versions of pretty much anything—sports highlights, art, tweets—authenticated using blockchain. That authentication creates a way to assign ownership of digital collector's items. Buying and selling NFTs can be extremely lucrative. In just one month last year, the Top Shot NFT market (officially licensed video highlights backed by the NBA) processed more than $250 million in sales from 100,000 buyers, according to The Wall Street Journal.

Some mayors are turning to NFTs and digital currency as a new outlet for raising revenue. Reno, Nevada Mayor Hillary Schieve is even working on a plan to sell an NFT of the city’s Space Whale sculpture. But on the taxing side, things are a bit complicated.

The problem is, NFTs act like tax code shapeshifters—sometimes it’s tangible property, sometimes it’s a video, other times it’s admission to a private event. And sometimes it’s a combination of things. “The true object of the transaction—and the character and taxability of each component—should be analyzed because the taxability of one component could cause the entire transaction to be taxable,” note KPMG tax experts Jeff Cook, Madeleine Smith, and Harley Duncan in a recent article.

Only Washington state has so far announced plans to issue tax guidance on NFTs, something a number of states are likely watching. The state’s Department of Revenue expects to publish its excise tax advisory later this year.

“Right now, state [departments of revenue] are trying to figure it out,” David Brunori, a public policy professor at the George Washington University, told Route Fifty. “If it becomes a major thing, like the internet, that’s going to last, they want to act sooner rather than later.”

A spokeswoman for Washington state’s DOR said its advisory on NFTs will address sales and use tax and business and occupation taxes, and that it may later address capital gains taxes. “New technologies, such as NFTs, generally fall under the broad definitions without need to amend the statute to specifically address the new technology,” she said via email.

When Robots Send Text Messages

Another growing category that’s hard to define is automated messages and other types of data sent by software. These digital service providers or DSPs, offer consumers and businesses a broad mix of capabilities, such as real-time usage alerts or appointment notifications.

They also operate within the Internet of Things, or IoT, which describes a network of physical objects—things—that are embedded with sensors and software enabling them to connect to the internet and exchange data with other devices and systems. Consumers use the technology for applications like smart appliances in their homes, but commercially this type of communication is exploding in areas ranging from digital supply chains to smart cities.

These communications are meant to make life easier for consumers and businesses, but like NFTs, they straddle taxation lines and can make life difficult for regulators.

“Sellers take the position that this is a software function so the sales tax has already been applied for that,” said Toby Bargar, a senior tax consultant at Avalara. But because the automated communications are a subscription-based information service, he believes that state and local governments will increasingly consider that to be a separate communications tax liability.

Some important questions for regulatory and taxing authorities to consider in this arena, according to a Deloitte analysis, are: What line of business is the manufacturer in? And has it crossed convincingly into a service business or even a telecommunications business?

As more companies increase their revenue streams via service and communications-type offerings, experts say departments of revenue are likely to move in.

Bargar says he’s keeping his eye on Florida to be the first state to start taxing the IoT because the state has the most broadly-defined communications tax. It was one of the first states to start taxing streaming services under its communications tax and, more recently, it started taxing video gaming site subscriptions.

“Florida is ground zero for a lot of that because they pioneered that catchall definition of communications services,” he said. “They’re at the forefront for a lot of those things.”

That’s it for this week’s edition of Public Finance Update. We’ll be back later this month with another issue. Thanks for reading!

NEXT STORY: Black Homeownership Declines as Overall Rate Rises