Connecting state and local government leaders

In particular, health care, housing and education seen as contributors to citizens’ financial woes.

An important new report from Gallup and the U.S. Council on Competitiveness provides a compelling analysis of the reasons for economic stagnation in the United States—and places significant blame on state and local regulatory practices.

The report, titled “No Recovery, An Analysis of Long-Term U.S. Productivity Decline,” gets behind the reasons why economic growth, as measured by Gross Domestic Product, has been so weak: increasing at a rate of just 1 percent since 2007 and 1.4 percent since 2009, when the “recovery” is said to have begun.

The 116-page report, which was released on Tuesday, takes a longer view of U.S. economic malaise, and attributes much of it to inefficiencies and rising costs in three key sectors: health care, housing and education. Together, these three sectors now consume 36 percent of total national spending—up from 25 percent in 1980. Absent that inflation, and the demands it puts on consumers’ incomes, Americans would have a lot more disposable income than they do at present.

The report takes note of stagnating or declining health among the U.S. population since 1980, with many more people reporting disabilities and use of painkillers, and says this is an important factor behind the drop in labor force participation rates. The country is not getting much bang for all the bucks it spends on health care, it says.

Educational quality is both weak and stagnant at all levels, and housing quality has been declining even as prices have been going up, the report adds.

Federal policy shoulders a lot of the blame, according to Jonathan Rothwell, a senior Gallup economist and the principal author of the report. Rothwell observes that the annual cost to the U.S. economy of major federal regulations has increased by $250 billion since 1981. The $250 billion a year is certainly not chump change, but the report also blames state and local governments for regulatory policies that add many billions of dollars in additional costs. Indeed, the focus on regulation is in line with what President-elect Trump has said he was hearing from business leaders during his campaign as their principal economic objective. A push for simplification of regulatory structures, at least at the federal level, is in store after Trump takes office: his website pledges to “reform the entire regulatory code to ensure that we keep jobs and wealth in America.”

State Labor Policies

Productivity gains have been declining, and the report places some of the blame on states’ labor force policies:

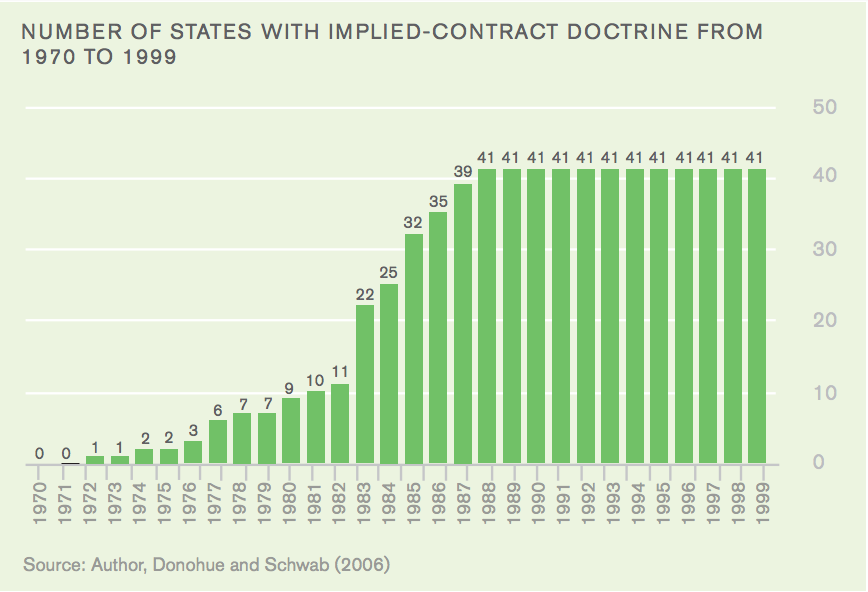

Another general factor behind the productivity slowdown is a change in how states have interpreted labor laws. Up until the 1970s and 1980s, the U.S. standard was that employers hired workers at will and could terminate them for any cause. Between 1970 and 1988, 41 state supreme or lower courts had adopted a major exception to the at-will doctrine known as implied-contract. The legal idea here is that almost any employer-employee relationship implies a contract stipulating termination only for cause, even if no such contract was ever signed. The problem is that this increases the risk of hiring, depressing the demand for labor. Economic and legal scholars compared state employment to population ratios just before and just after these court decisions and calculated that these laws reduced the employment-to-population ratio by 0.8 to 1.7 percentage points.

Housing

American families that rent their residences now spend about 28% of their incomes for their abodes, up from 19 percent in 1980, and the cost of owning a home has also increased substantially, the report says. Lagging supply is a principal reason, and local government shoulder much of the blame:

Local land-use regulations explain why housing markets are so dysfunctional. The core problem with the housing market is that it is not allowed to function as a market at all. In a healthy market, an increase in demand for a product leads to a greater supply and prices stay the same. In housing markets, demand increases as new households are formed, which results from natural population growth and immigration. The problem is that new supply is massively restricted, leading to inflation.

The development of new housing units is restricted by a massive layer of local regulations called zoning that block new housing from being built and being built where people most want to live. Zoning forces artificially low housing densities in many desirable locations and often blocks new development of any density. Regulations often outlaw apartment buildings, condos and even single-family attached townhouses from the most expensive neighborhoods. The vast majority of local governments surveyed (84 percent) report that they require minimum lot sizes that are designed to limit density. A large academic literature shows that more restrictive zoning laws drive up housing costs.

Local zoning boards and planning agencies have almost complete discretion over what gets built where, and they are under intense political pressure from homeowners’ associations and other groups to block development in high-priced, low-density areas for cultural and economic reasons. Culturally, homeowners clamor to preserve what they regard as the “character” of their communities, by which they mean things like traffic, the race and social status of their neighbors, and environmental amenities like green space and scenic views. Additionally, homeowners have strong economic interests in restricting the supply of housing in their neighborhood for two reasons: having more people, especially people with young children, requires a higher tax rate on property, and even more fundamentally, greater housing supply in their neighborhood lowers the value of their unit relative to the prevailing scarcity. Thus, even as housing prices increased, U.S. population density actually fell from 2000 to 2010 for metropolitan area residents as newer housing units were pushed further out into the distant suburbs.

Health Care

The report details inefficiencies and suboptimal outcomes in American health care. The American consumer is paying more but not getting much better results, it finds. As an example, health care as a share of worker compensation has increased from 4.5 percent in 1980 to 8.1 percent in 2015. Again, state policies shoulder much of the blame:

State-level occupational restrictions drive up costs for primary healthcare and dental care services. As the U.S. economy has shifted toward services and away from agriculture and manufacturing, interests groups have formed and lobbied successfully at the state level to regulate professional occupations. In 1950, just 5% of workers required a state license to perform their occupation. Presently, the share is 22%, according to recent survey data from the Bureau of Labor Statistics, and as high as 29% in other estimates.

Many of these regulations stipulate in detail the sorts of activities that can and cannot be performed by people with varying levels of approval. In part, these rules serve the public by guaranteeing some level of oversight and competence for important services, but these regulatory boards can easily abuse the power given to them to the detriment of the public.

These regulations have profound effects on the cost of healthcare. For example, nurse practitioners’ training has essentially prepared them to perform the functions of family and general practice physicians, and yet state law prohibits them from practicing independently from physicians in most cases. Existing evidence is clear that the patients of nurse practitioners have outcomes that are at least as good as patients seen by physicians. Based on this evidence, the National Academy of Sciences issued a forceful recommendation that states reform their restrictions on nurse practitioners to grant them full practice.

In spite of the fact that nurse practitioners have the training and track record to show they are just as capable as physicians at providing general and family healthcare services, nurse practitioners are paid far less. The average nurse practitioner salary in 2015 is $101,000, roughly half of the $192,000 earned by family and general practitioners. Physician clinics generated $425 billion in revenue in 2014, so shifting primary healthcare services to nurse practitioners would save hundreds of billions of dollars in healthcare spending.

The reason more patients don’t see nurse practitioners is that many states force them to work under the direct or indirect supervision of physicians. Just 22% of nurse practitioners live in states that allow them to practice independently of physicians.

Looking to the Future

Gallup promises additional papers suggesting ways to improve economic performance in the three key underperforming sectors and in other dimensions of the economy. It calls for an entirely new look at strategies for growth, concluding that “what’s clear is that current strategies—dialing taxes up or down, injecting stimulus, lowering interest rates and enacting or repealing high-profile regulations—have not brought about long-term economic growth over the past three or four decades.”

Timothy B. Clark is Editor at Large at Government Executive’s Route Fifty.

NEXT STORY: GOP Eyes Plan to Eliminate Obama’s National Monuments; California’s Preemptive Move on Immigration