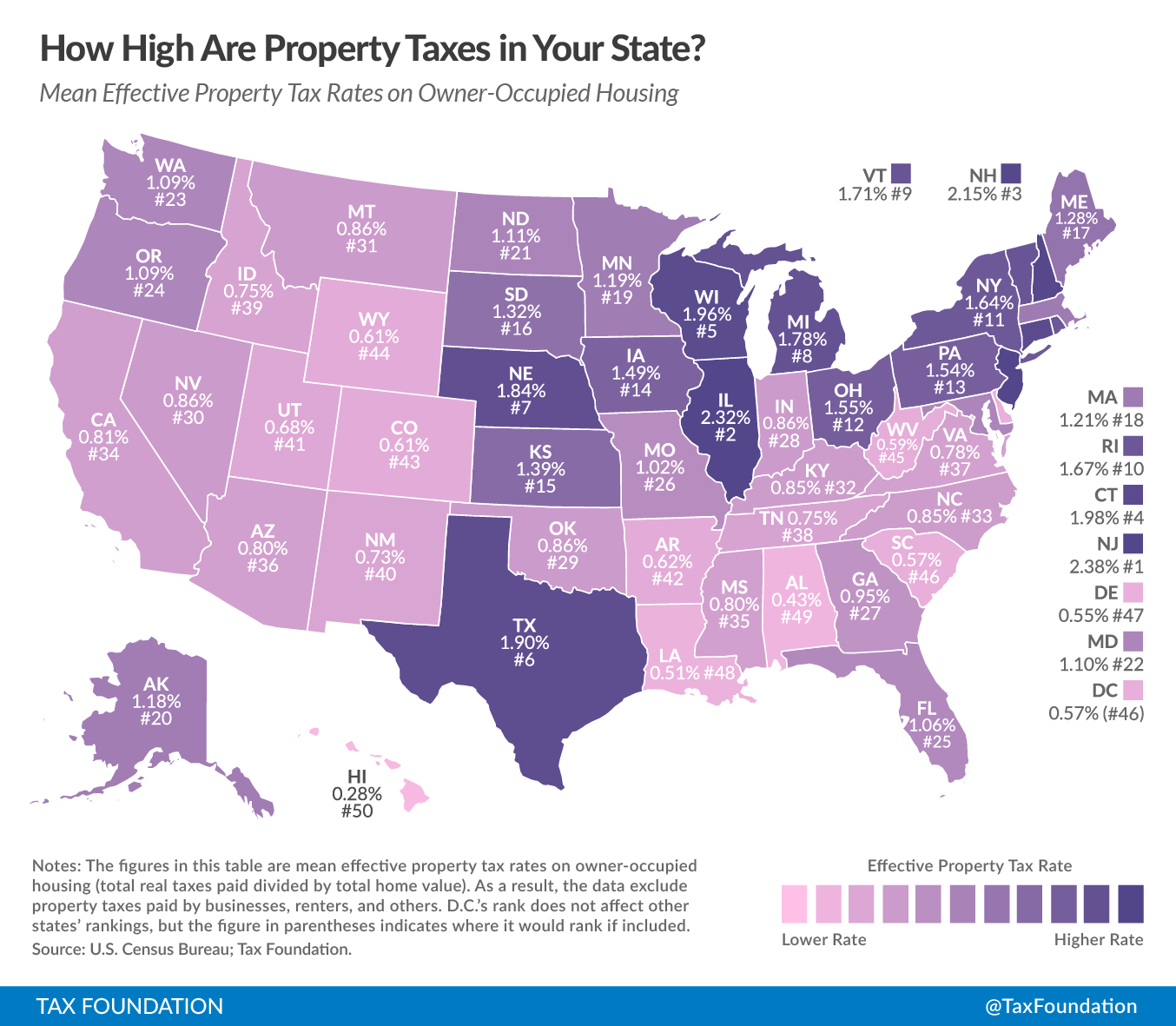

New Jersey Tops Rankings of State Property Tax Rates

Beachfront homes in Cape May, New Jersey Joseph Sohm / Shutterstock.com

Where does your state stack up compared to the Garden State?

New Jersey came out on top in a ranking of state property tax rates that the nonprofit Tax Foundation released late last week.

Jared Walczak, a policy analyst at the foundation’s Center for State Tax Policy, notes that because there are differences in the way property taxes are calculated across the nation, state-to-state comparisons can be tricky. Further complicating matters are state-specific statutory requirements and tax-levying political subdivisions, such as school districts and utilities.

The Tax Foundation’s figures are an attempt at presenting effective rates that allow for a fair nationwide comparison.

Looking only at owner-occupied housing, the numbers are meant to show “the average amount of residential property tax actually paid, expressed as a percentage of home value.”

For the Garden State, that average rate checked in at 2.38 percent.

The other states that cracked the top five included: Illinois (2.32 percent), New Hampshire (2.15 percent), Connecticut (1.98 percent) and Wisconsin (1.96 percent).

At the bottom of the list were South Carolina (0.57 percent), Delaware (0.55 percent), Louisiana (0.51 percent), Alabama (0.43 percent) and Hawaii (0.28 percent).

Walczak discussed the the Tax Foundation’s analysis in a blog post on the organization’s website.

He points out:

Some states with high property taxes, like New Hampshire and Texas, rely heavily on property taxes in lieu of other major tax categories; others, like New Jersey and Illinois, impose high property taxes alongside high rates in the other major tax categories.

The Tax Foundation describes itself as nonpartisan, but has been characterized by some as right-leaning. And, in years gone by, the foundation has sparred with other groups over the methodology behind of some of its state and local tax rankings.

(Photo by Joseph Sohm / Shutterstock.com)

Bill Lucia is a Reporter for Government Executive’s Route Fifty.

NEXT STORY: Why State and Local Governments Are Increasingly Embracing GitHub