Senate Approves Democrats' Sweeping Climate and Health Bill

The U.S. Capitol building is seen on the evening of August 6, 2022 in Washington, DC.The U.S. Senate plans to work through the night to vote on the Inflation Reduction Act, Anna Rose Layden/Getty Images

Connecting state and local government leaders

The legislation would unlock billions in new grants for states and local governments. But some lament its lack of help on housing and other issues. It will next go to the House.

Democrats’ multi-billion dollar climate, health care and tax package cleared a major hurdle on Sunday after the Senate passed the measure in a strictly party-line 51-50 vote, with Vice President Kamala Harris breaking the tie.

The bill, which includes around $370 billion for climate and energy programs, is expected to get a vote in the Democratic-controlled House on Friday. If approved there, it would go to President Biden for his signature. The legislation would send billions in climate funding to states and local governments—notably $4.75 billion to reduce greenhouse gas air pollution.

A smiling Senate Majority Leader Chuck Schumer, of New York, stepped off the floor after the vote giving reporters a big thumbs up.

“We did it,” he said.

Sen. Brian Schatz, a Democrat from Hawaii, was near tears. “I’m so glad we were able to do something about climate change," he said.

Casey Katims, executive director of the U.S. Climate Alliance, a bipartisan group of 24 governors who have pledged to take action to confront climate change, described the bill as “a watershed moment," adding that opportunities to curb climate-warming emissions will “look a little different in every state.”

Katims said it is exciting that the bill includes funding to help states create rebate programs for residents to make home upgrades that could improve energy efficiency and decrease reliance on fossil fuels. He also highlighted grants that will go towards helping disadvantaged communities deal with climate change.

David Painter, a Clermont County, Ohio commissioner and chairman of the National Association of Counties’ environment, energy and land use committee, was also impressed by the legislation.

“I was really surprised when I completely read through the bill, how packed it was with climate incentives,” he said.

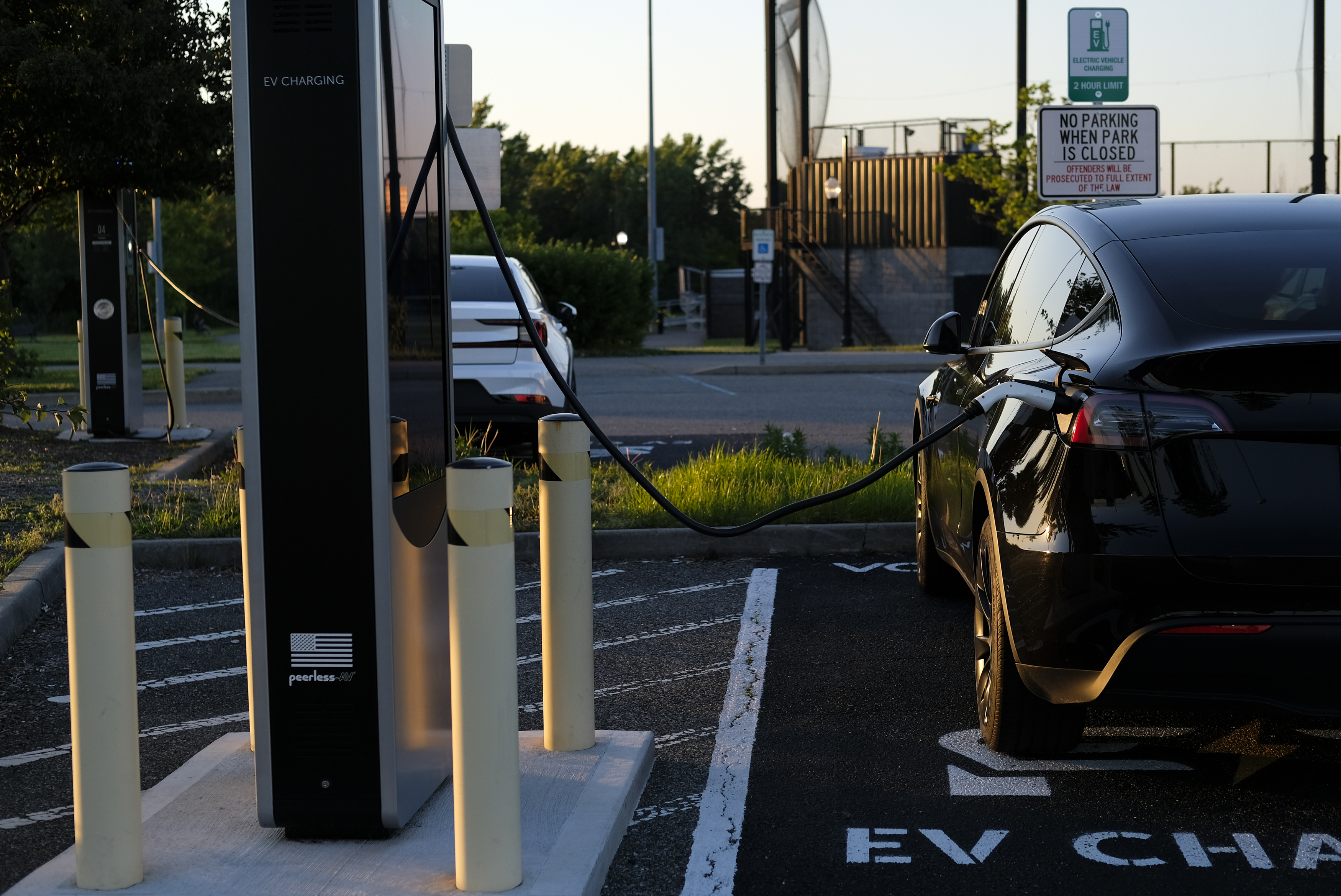

Painter, for instance, said he was talking to the county’s economic development director about electric vehicle tax credits in the bill and said it could be significant for bus service the county operates to Cincinnati.

“This is going to give us an option to replace some of the vehicles in our fleet,” he said.

The bill’s passage will likely please a number of associations representing local governments that support it.

In addition to what Democrats termed “historic amounts” of funding to combat climate change, the bill would provide $64 billion to extend, for another three years, health insurance subsidies created in the American Rescue Plan Act. State health officials are worried that about 3 million people would no longer be able to afford health care coverage if the subsidies were allowed to expire at the end of the year.

The legislation would also allow Medicare to negotiate lower drug prices with pharmaceutical companies.

Central to the bill on the revenue side is a 15% minimum tax that would apply to large companies that currently avoid paying the standard 21% corporate tax rate. The tax was expected to raise about $258 billion over the next decade—down from $313 billion in an earlier version of the legislation after lawmakers agreed to changes backed by Democratic Sen. Kyrsten Sinema, of Arizona.

But Sinema and a handful of other swing state Democrats on Sunday backed an amendment put forward by Senate Minority Whip John Thune, a South Dakota Republican, that tweaked the tax further to exempt more businesses from it. To pay for that change, Thune's amendment called for extending by one year, to Jan. 1, 2027, the expiration date for a $10,000 cap on the amount of state and local taxes people can deduct when filing their federal taxes.

That move would have drawn opposition from a group of Democrats who have pushed to lift the cap since Republicans passed it in 2017. But Sen. Mark Warner, a Virginia Democrat, headed off the conflict, putting forward an amendment that was approved to swap out the "SALT" extension, and make up for the revenue it would have provided, by extending the limit on an unrelated tax break.

Democrats' legislation would take “critical steps to slash carbon emissions, lower costs for families, provide affordable health care, and so much more,” Tom Cochran, CEO and executive director of the U.S. Conference of Mayors said in a statement last week. Those issues, he said, are key priorities for mayors.

At the same time, though, there was disappointment among those who had hoped the bill would do even more, including increasing the SALT cap, as well as providing additional funding for housing, workforce development and childcare.

Should the bill make it to Biden’s desk, it would mark the end of a year-and-a-half of infighting among Democrats over what began as President Biden’s $2 trillion American Jobs Plan Act that addressed both physical and so-called “human infrastructure.”

When moderate House Democrats balked at the size of the initial package, Congress split off what became the bipartisan $1.2 trillion Infrastructure Investment and Jobs Act, which Biden signed last year.

Moderate Senate Democrat Joe Manchin, of West Virginia, along with Sinema, then blocked the passage of the separate $1.75 trillion Build Back Better Plan, which would have included $170 billion for housing, $555 billion for climate programs, as well as raising the limit on the SALT deduction.

Instead, Democrats could only muster support for the latest bill, the Inflation Reduction Act, negotiated by Manchin and Senate Majority Leader Charles Schumer, of New York.

“There's nobody who can deny that this legislation does not address the major crises facing working families,” Sen. Bernie Sanders, a Vermont Independent, told reporters on Saturday. “In terms of prescription drugs, people got to know that Medicare will not be negotiating prescription drug prices for four years and then it is for a small fraction of the number of drugs that are out there.”

“This bill has nothing to say about the housing crisis, the childcare crisis, the crisis of higher education,” Sanders added, but he ultimately voted for the measure.

Diane Yentel, president and CEO of the National Low Income Housing Coalition, said in a statement it was a, “deeply disappointing and tremendously short-sighted decision to leave housing out” of the package.

“Housing costs are a primary driver of rising inflation. An ‘inflation reduction act’ that doesn’t address skyrocketing rents and dwindling housing supply misses the point and leaves the lowest income renters and people experiencing homelessness to suffer from continued inaction,” she added.

Ann Oliva, CEO of the National Alliance to End Homelessness, also said the bill fell short.

"All over the country, local leaders are demanding solutions to the dual crises of homelessness and affordable housing. And for those struggling the most in this economy, few investments could have a greater impact than affordable housing would,” she said in a statement to Route Fifty. “Yet, there are no meaningful affordable housing provisions in the Inflation Reduction Act. These investments have been overdue for decades. Their absence could impact the nation for generations."

The National Association of Counties expressed some disappointment that the measure does not address raising the SALT cap. NACo also lamented that the bill does not include a provision allowing incarcerated people to receive Medicaid beginning 30 days before their release, or a requirement for states to extend Medicaid and Children’s Health Insurance Program postpartum services from 60 days to 12 months.

While the Center on Budget and Policy Priorities called the bill “an important step forward,” the liberal think tank also said it “squandered” an opportunity to encourage states that have not expanded Medicaid coverage under the Affordable Care Act to do so—a move the group says would help to expand access to health coverage to around 2.2 million people. The Build Back Better proposal would have increased the federal share of Medicaid funding for states willing to expand eligibility for the program.

Republicans, who unanimously opposed the bill, blasted it as too expensive and for its taxes on businesses.

“We’re running a deficit in these times,” Sen. Rick Scott, a Florida Republican, and the state’s former governor told Route Fifty in an interview. “We should help people if they need help” but in a fiscally responsible way, he said.

Thune, speaking on the Senate floor on Thursday, said the package would “double down on Democrats’ wasteful government spending.”

He took particular aim at the $1.5 billion in grants the bill would give to states, localities and nonprofits to plant trees, with an emphasis on underserved areas, as well as funding to identify gaps in tree coverage.

“If this new partisan tax-and-spending spree passes, Americans can look forward to a lot more economic pain in the future,” Thune said. “But at least they’ll be able to console themselves with the knowledge that their tax dollars are going to fund tree canopies.”

But funding for climate programs drew praise from local government groups.

The association of counties noted that, in addition to funding for air pollution reduction, the bill includes a number of other grants, including a $3 billion competitive grant program to reduce air pollution at ports and $7 billion to provide financial assistance to low-income and disadvantaged communities to deploy, or benefit from, technologies that can help cut emissions.

The group also mentioned the $3 billion Neighborhood Access and Equity Grant program, which could help pay for projects to remove and revamp highways built in past decades that carved apart city neighborhoods and displaced residents.

And NACo applauded that the bill would allow Medicare to negotiate down medication prices with drug companies.

But the National Academy for State Health Policy, made up of state health officials, noted that the bill does not include provisions that would have applied the lower prices to commercial insurance and, in turn, helped to save states and localities money.

Sen. Ron Wyden, an Oregon Democrat and chairman of the Senate Finance Committee, told reporters on Saturday that the private insurers will likely demand the same lower prices as Medicare is being charged. “This is a seismic shift,” he said.

Painter, the county official in Ohio, said the bill could help his community deal with the closure of two coal plants, which eroded local government revenue for schools. He noted that incentives for wind power development could possibly offer a boost on this front, but also acknowledged local concerns about wind farm facilities reducing the amount of land available for agriculture.

Kery Murakami is a senior reporter for Route Fifty.

NEXT STORY: Hopes Dim for Lifting SALT Cap in Senate Deal